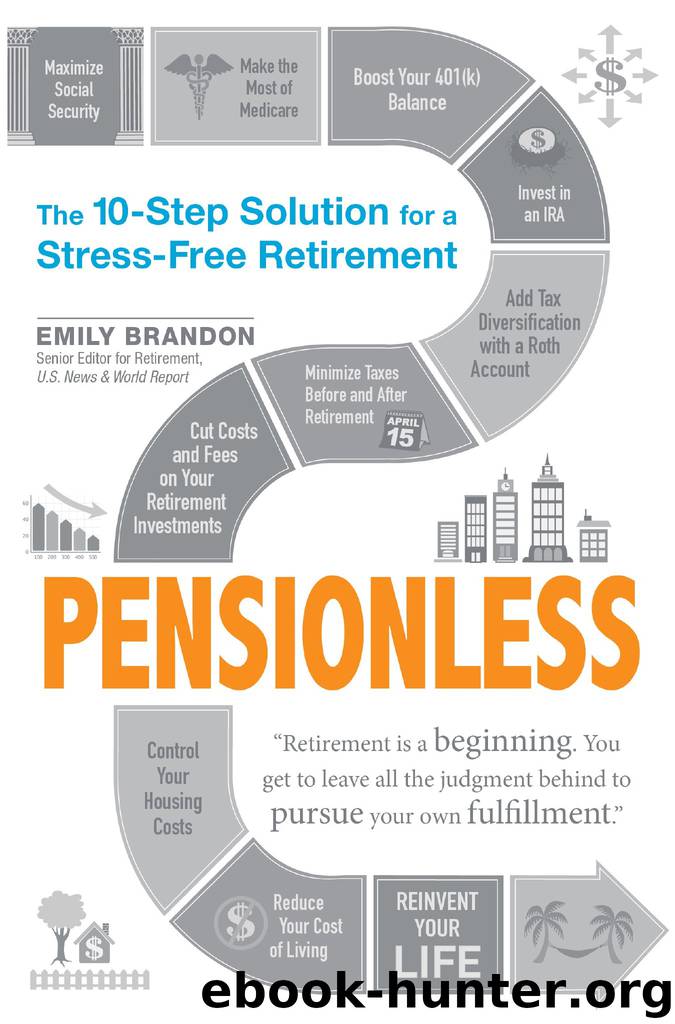

Pensionless by Emily Brandon

Author:Emily Brandon

Language: eng

Format: epub

Publisher: F+W Media

Published: 2016-03-03T16:00:00+00:00

Distributions from Roth Accounts

You are required to take withdrawals from Roth 401(k) accounts beginning after age seventy-and-a-half. However, if you are still working for a company you don’t have an ownership stake in, you can delay withdrawals from your Roth 401(k) until you actually retire. Withdrawals from Roth 401(k)s that are at least five years old will not be taxed if you’re over age fifty-nine-and-a-half. You are not required to withdraw money from a Roth IRA during your lifetime.

If you withdraw money from a Roth account before it is five years old you may have to pay tax on a portion of the distribution. The five-year period in which you could be taxed begins on the first day of the year in which you begin to contribute to the Roth account. The amount that you contribute to the account is not considered income or taxed, even if you withdraw it in the first five years you own the account. But the earnings the account generates could be taxable if you withdraw the money before the account is five years old and you reach age fifty-nine-and-a-half.

Roth IRAs and Roth 401(k)s treat early withdrawals differently. When you take an early distribution from an IRA, your nontaxable contributions are withdrawn before any of your taxable earnings. If you withdraw an amount equal to or less than the amount you contributed to the account, the distribution won’t be taxable. However, early withdrawals from Roth 401(k)s are prorated between your Roth contributions and earnings. So, a portion of an early Roth 401(k) withdrawal is likely to be taxable.

The taxable portion of a Roth 401(k) distribution is calculated by multiplying the amount you withdrew by the ratio of Roth contributions you made to the total account balance. For example, if you withdraw $5,000 from a Roth account to which you contributed $9,400 and the account accumulated $600 in investment gains, $4,700 of the withdrawal is not taxable and $300 will be taxed as income.

If you roll over a Roth 401(k) to a new Roth IRA, the five-year period when earnings are taxable starts over again. However, if you roll over your Roth 401(k) to an existing Roth IRA, the five-year taxable period is measured from the earlier contribution. So, if you are over age fifty-nine-and-a-half and the earlier contribution was made more than five years ago, you could withdraw your most recent rollover without paying tax on it. To make sure your retirement distributions from Roth accounts will be completely tax free, take care to set up an account five or more years before you would like to take distributions.

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

| Budgeting & Money Management | College & Education Costs |

| Credit Ratings & Repair | Retirement Planning |

The Compound Effect by Darren Hardy(8978)

Tools of Titans by Timothy Ferriss(8403)

Nudge - Improving Decisions about Health, Wealth, and Happiness by Thaler Sunstein(7712)

Win Bigly by Scott Adams(7204)

Deep Work by Cal Newport(7092)

Rich Dad Poor Dad by Robert T. Kiyosaki(6646)

Principles: Life and Work by Ray Dalio(6466)

Pioneering Portfolio Management by David F. Swensen(6305)

Digital Minimalism by Cal Newport;(5769)

The Barefoot Investor by Scott Pape(5754)

Grit by Angela Duckworth(5623)

The Slight Edge by Jeff Olson(5421)

Discipline Equals Freedom by Jocko Willink(5394)

The Motivation Myth by Jeff Haden(5217)

You Are a Badass at Making Money by Jen Sincero(4935)

The Four Tendencies by Gretchen Rubin(4608)

Eat That Frog! by Brian Tracy(4547)

The Confidence Code by Katty Kay(4268)

Bullshit Jobs by David Graeber(4197)